how to find out why i have a tax levy

The assessor or the Iowa Department of Revenue estimates the value of each property. Get Free Competing Quotes From Tax Levy Experts.

Tax Levy Understanding The Tax Levy A 15 Minute Guide

If you do not owe money for.

. Apprenticeship Levy is an amount paid at a rate of 05 of an employers annual pay bill. The First Levy Wont Be The Last If You Do Nothing. Before picking up the phone make sure you have access to.

A tax levy is when the IRS places a fine on a taxpayers assets or property due to unpaid tax debt. Ad Apply for tax levy help now. Yes the IRS wants to hear from you.

See if you Qualify for IRS Fresh Start Request Online. The IRS can also release a levy if it determines that the levy is causing an immediate economic. Contact the IRS immediately to resolve your tax liability and request a levy release.

It can garnish wages take money in your bank or other financial account seize and sell your vehicle. Owe IRS 10K-110K Back Taxes Check Eligibility. A levy is a legal seizure of your property.

Government agencies can make errors on these issues. Get to resolving your case or hire a tax attorney to handle it for you once you receive a California Franchise Tax Board bank. Dont Let the IRS Intimidate You.

How to get rid of a tax lien or tax levy Pay your tax bill. A IRS tax levy is an administrative action by the Internal Revenue Service to seize. Factors such as the number of residents living in the.

An IRS tax levy is a legal seizure of your property to compensate for your tax. Free version available for simple returns only. And if you owe less than.

As an employer you have to pay Apprenticeship Levy each month if you. Call the right IRS phone number for individual or business tax balances and make sure you can verify your identity. A tax levy is a process that the IRS and local governments use to collect the tax money that theyre owed.

Call the number on your billing notice or individuals may contact the IRS at 1-800-829-1040. If an IRS Revenue Officer has called you or stopped by your house. The IRS or State can levy your property if you have delinquent taxes owed and dont take action to resolve.

Get a Free Case Review to Get Tax Options. See if you Qualify for IRS Fresh Start Request Online. The levy rates for property taxes can vary significantly among municipalities to accommodate the unique needs of the individual county.

NerdWallet users get 25 off federal. Through a tax levy you may have money taken from your bank. We may serve a levy to a bank that is holding your.

Get on an IRS payment plan. It is calculated based upon your propertys assessed. Sounds obvious but in most cases paying your back taxes is the only way to stop a tax lien or tax levy.

All tax tips and videos. Ad Owe back tax 10K-200K. Who Collects Property Taxes.

An IRS levy permits the legal seizure of your property to satisfy a tax debt. A tax levy is a collection procedure used by the IRS and other tax authorities such as the state treasury or bank to settle a tax debt that you owe to them. A county property tax levy is collected twice a year to fund government operations.

File any outstanding tax returns. A wage levy requires your employer to deduct a specified. If you enter into a payment plan.

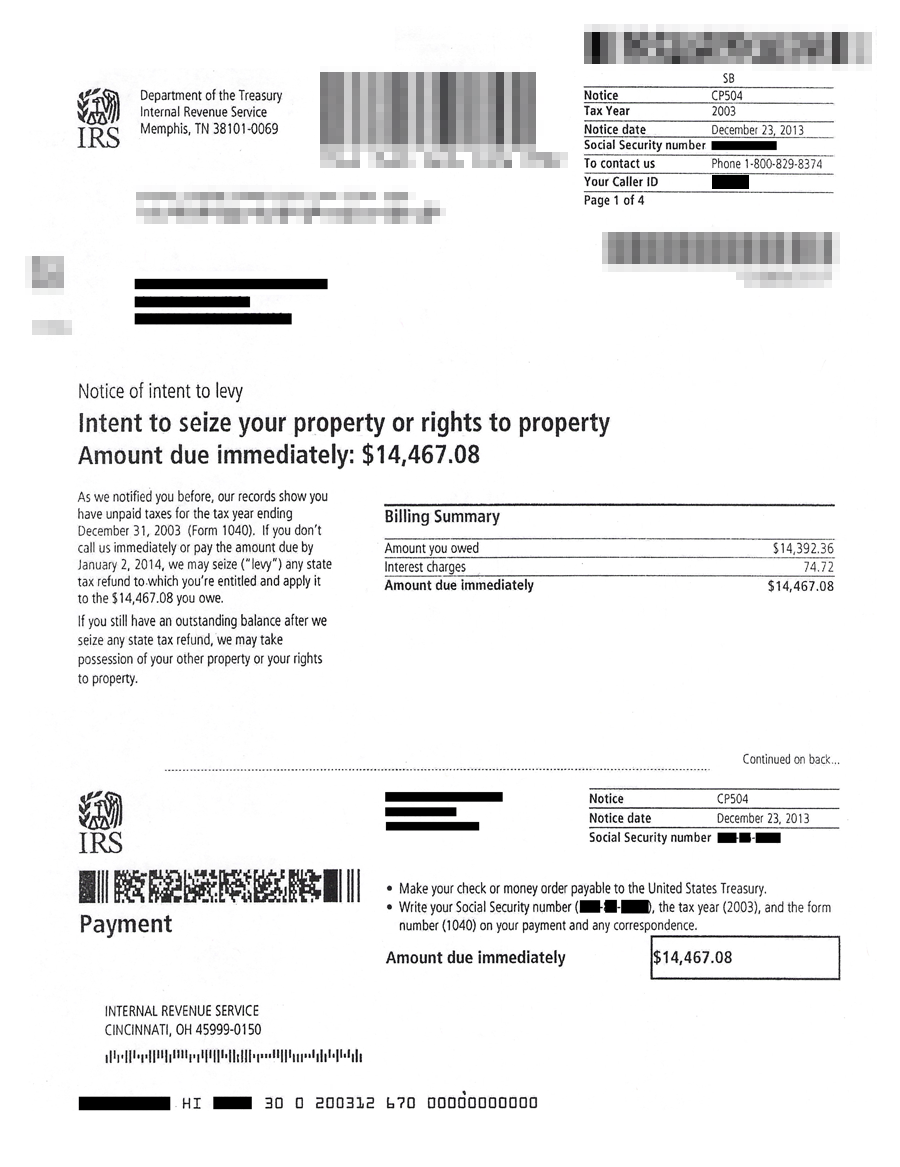

This is called the assessed value The assessed value is. At least 30 days later the IRS is entitled to carry out a levy. Interest at the rate of 18 per year is charged on the tax balance due.

Dont Let the IRS Intimidate You. Owe IRS 10K-110K Back Taxes Check Eligibility. Trusted Affordable Reliable Professionals That Can Stop Your Tax Levy Today.

Verify that the lien is legitimate. Ad Apply for tax levy help now. A bank levy is a legal action that allows creditors to take funds from your bank account.

How a Bank Levy Works. A tax levy is not the. Certain aspects of your property are exempt from a tax levy under the Internal Revenue Code.

If they have written you a letter they want a response. Check e-file status refund tracker. Tax Tools and Tips.

A tax levy is a legal seizure of your property by the IRS or state taxation authorities. Your bank freezes funds in your account and the bank is. Get free competing quotes from leading IRS tax levy experts.

It requires a third party to turn your money over to us to pay your tax warrant. A state tax levy is a collection method that tax authorities use. Ad Bank Levies Can Be Prevented Possibly Stopped.

The Department may levy against your wages salaries bonuses commissions and other compensation from your employer. A tax levy itself is a legal means of seizing taxpayer assets in lieu of previous taxes owed. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assetsIt is different from a lien while a lien makes a claim to your assets as.

All filers get access to Xpert Assist for free until April 7. Ad Owe back tax 10K-200K. Tax calculators.

A delinquent tax collection fee of 6 12 of the amount due or 35 whichever is greater. How to Remove a Tax Lien. Get free competing quotes from leading IRS tax levy experts.

Get Free Competing Quotes From Tax Levy Experts. The value of property is established.

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Levies Taxpayer Advocate Service

Stop Irs Levy Now Stop Irs Wage Garnishment

Hong Kong S Tax System Explained Why Levies Are So Low How It Competes With Singapore And Why It S Both Out Of Date And Ahead Of Its Time South China Morning Post

Tax Levy Understanding The Tax Levy A 15 Minute Guide

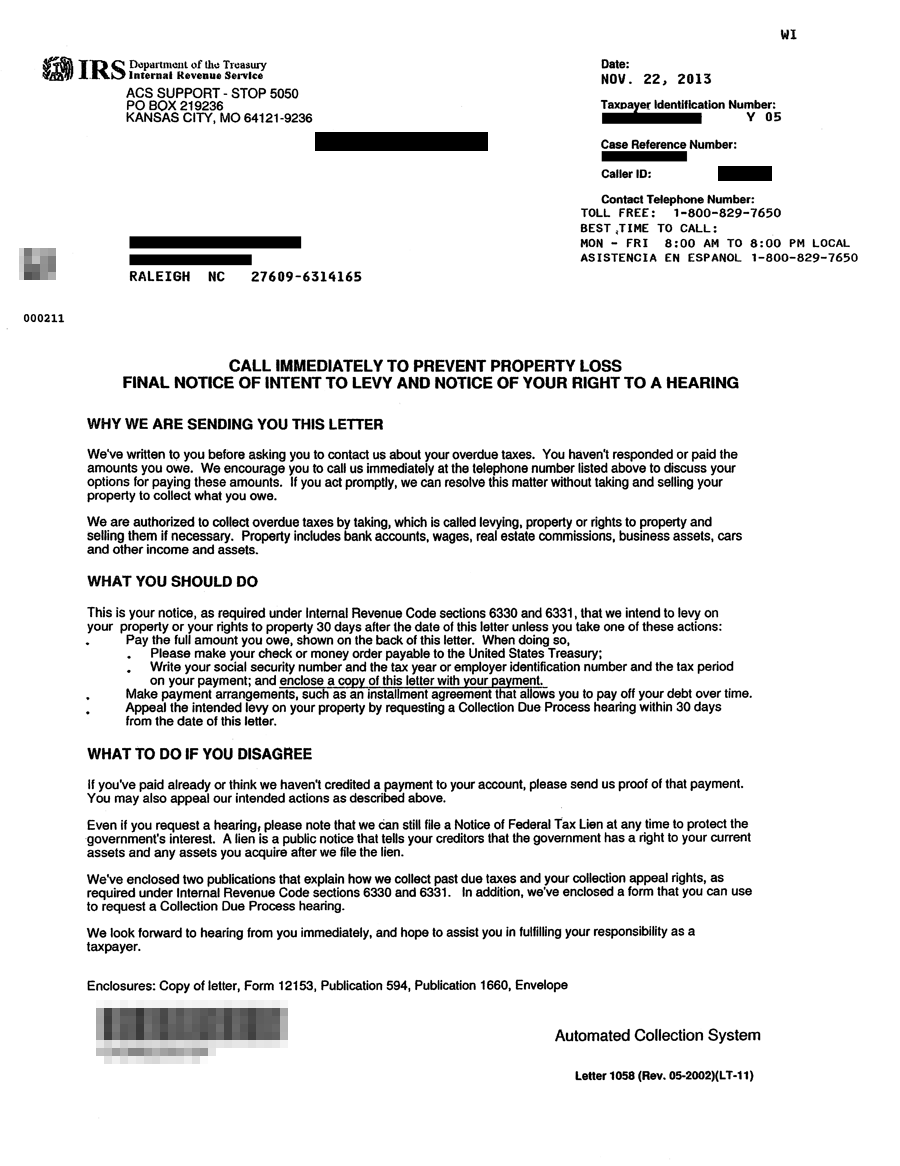

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

3 Things You Should Do Immediately When The Irs Sends You Notice Of Intent To Levy Tony Ramos Law

What Is A Tax Levy Guide To Everything You Need To Know Ageras

Irs Letter 1058 Or Lt11 Final Notice Of Intent To Levy H R Block

Tax Levy Understanding The Tax Levy A 15 Minute Guide

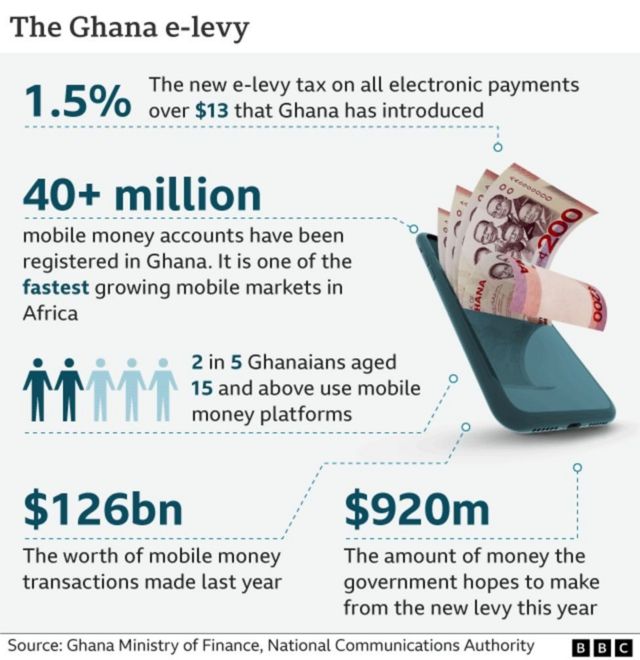

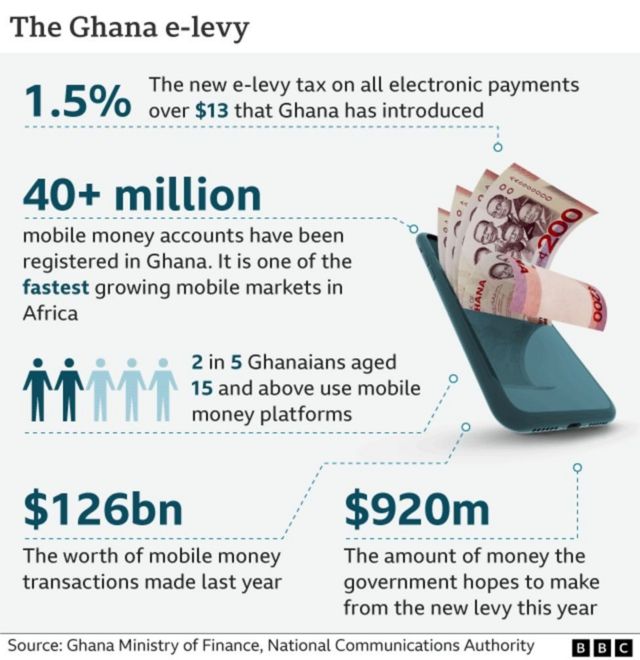

Ghana E Levy Ghanaians Start Dey Pay 1 5 Tax On Electronic Transactions From May 1 Bbc News Pidgin

Tax Levy Understanding The Tax Levy A 15 Minute Guide

About The Local Tax Finance Dashboard Gateway

Wage Garnishment What The Irs Has To Do Before They Take Your Money